How do I model a Defined Benefit Pension?

A defined benefit pension plan is a type of retirement plan where an employer promises a specific monthly benefit amount to an employee upon retirement.

To model a Defined Benefit pension:

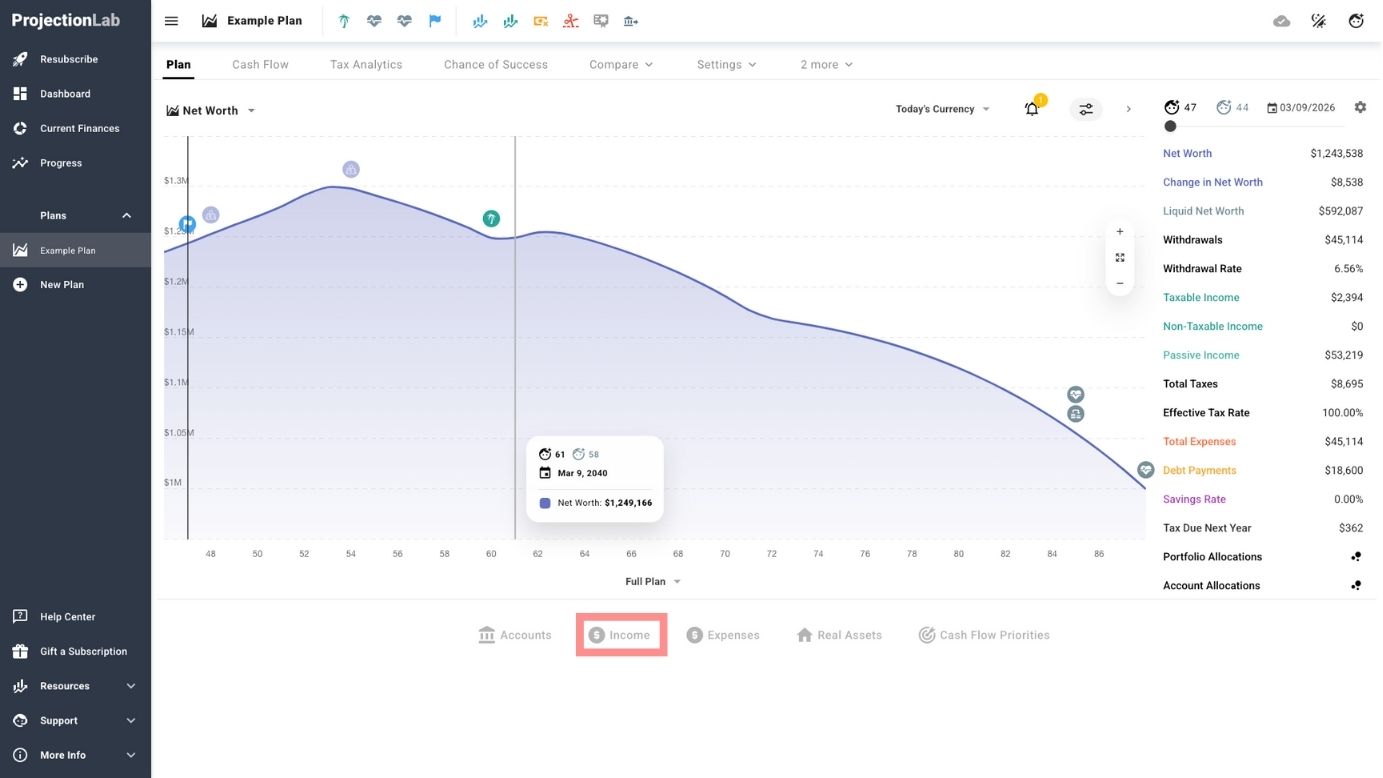

- Navigate to the Income section of your plan.

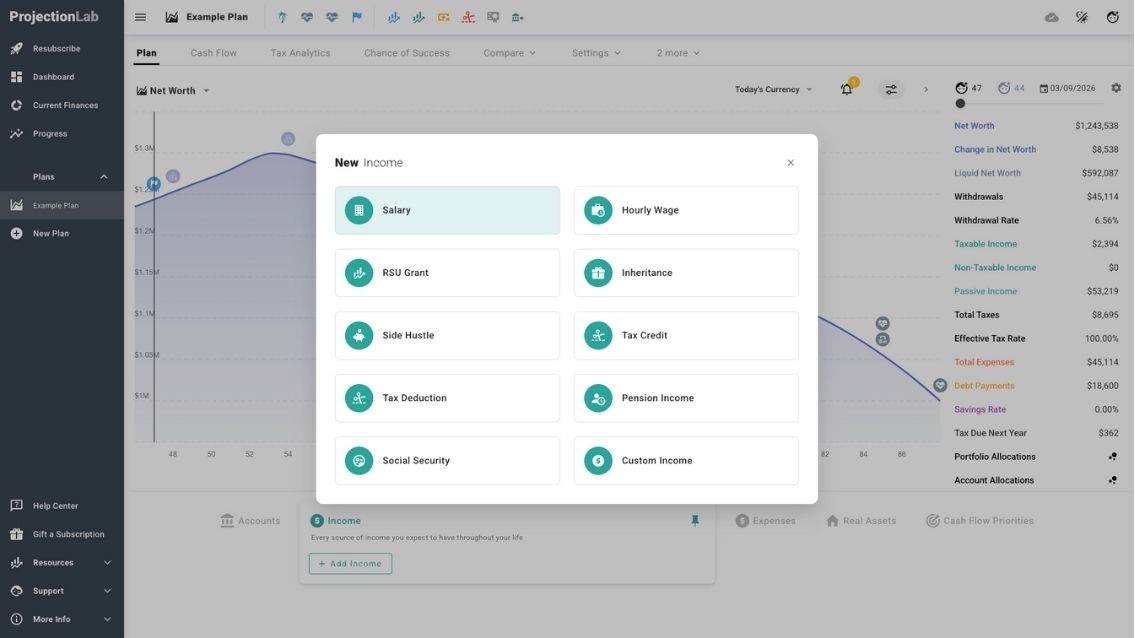

- Add a new Salary event.

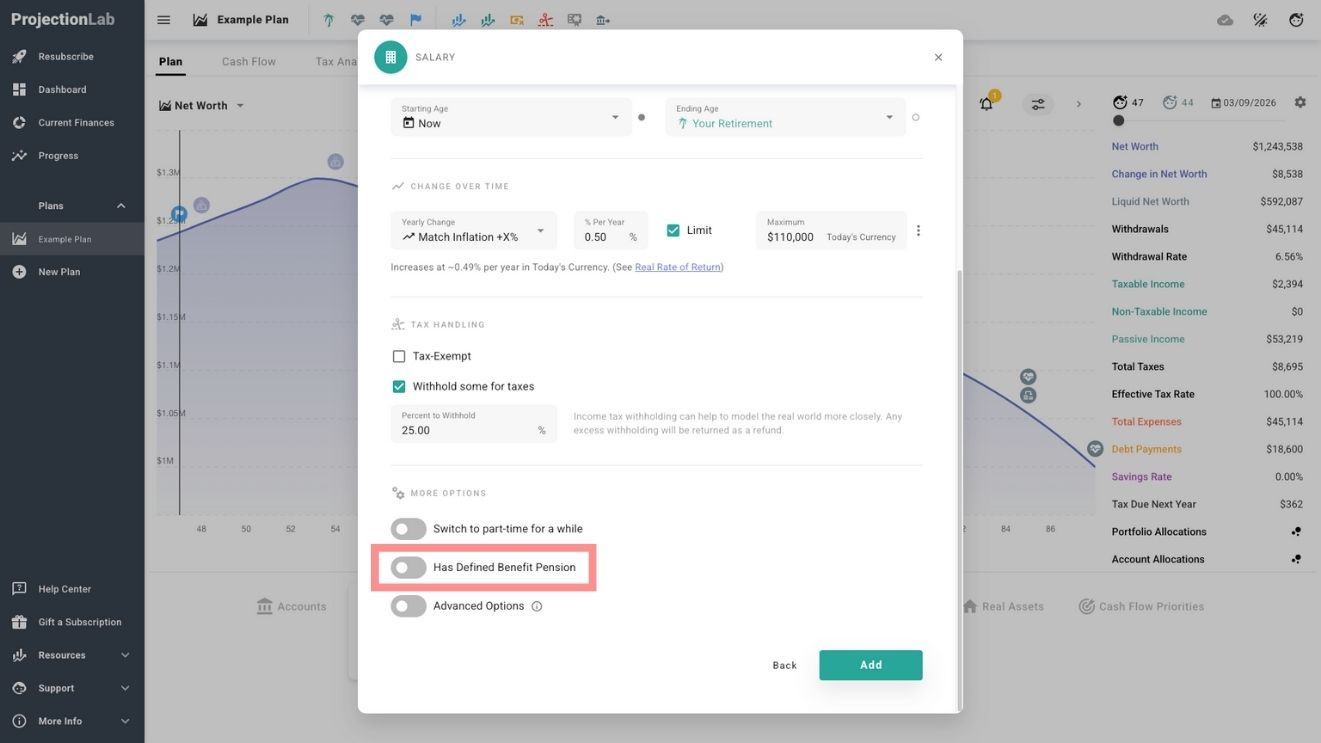

- After inputting your salary Starting Amount, Years in Effect, Change Over Time, and Tax Handling, scroll down to “More Options” and toggle on “Has Defined Benefit Pension.”

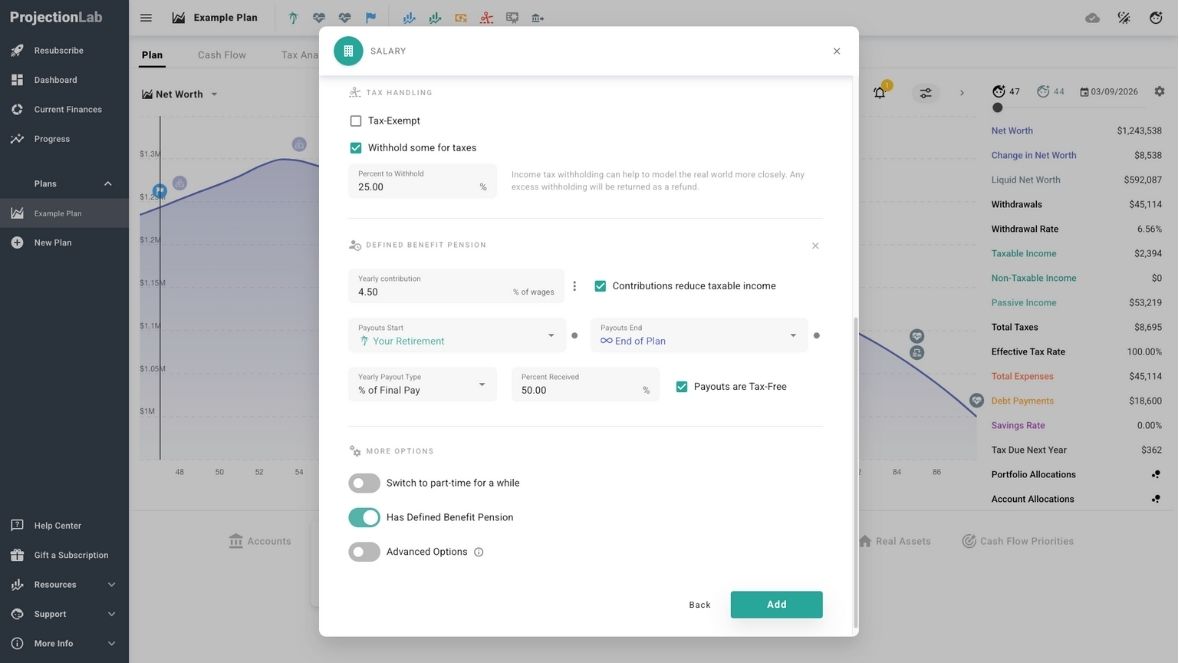

- Next, input your Yearly contribution:

- Either as a % of Wages for any year the salary is active, or as an Amount in Today’s Currency. (Learn more about the difference between Today’s and Actual Currency in ProjectionLab)

- Choose a Payouts Start date (by age/calendar year, or milestone), and then select a Payouts End date.

- When payouts begin, select the payout calculation method:

- Yearly Payout Type:

- % of Final Pay: Enter the percentage of your last paycheck you’ll receive during the defined payout period.

- % of Career Average Pay: Enter the payout percentage you will receive of the average value of this salary across plan years from its Start to End ages.

- Amount in Today’s Currency: Enter your expected annual benefit amount in current dollars (this will also adjust for inflation).

- Percent Received: Specify how much of the defined benefit pension you expect to receive for the options % of Final Pay or % of Career Average Pay.

- Payouts are Tax Free: Check this box if your pension payouts are tax-free.