How can I model moving to a state with lower taxes?

If you’re planning a move to a state with lower taxes and want to account for this change in your financial plan, ProjectionLab makes it simple through the Milestones system. Follow these steps to reflect the appropriate tax changes in your plan:

Step 1: Create a Milestone for Your Move

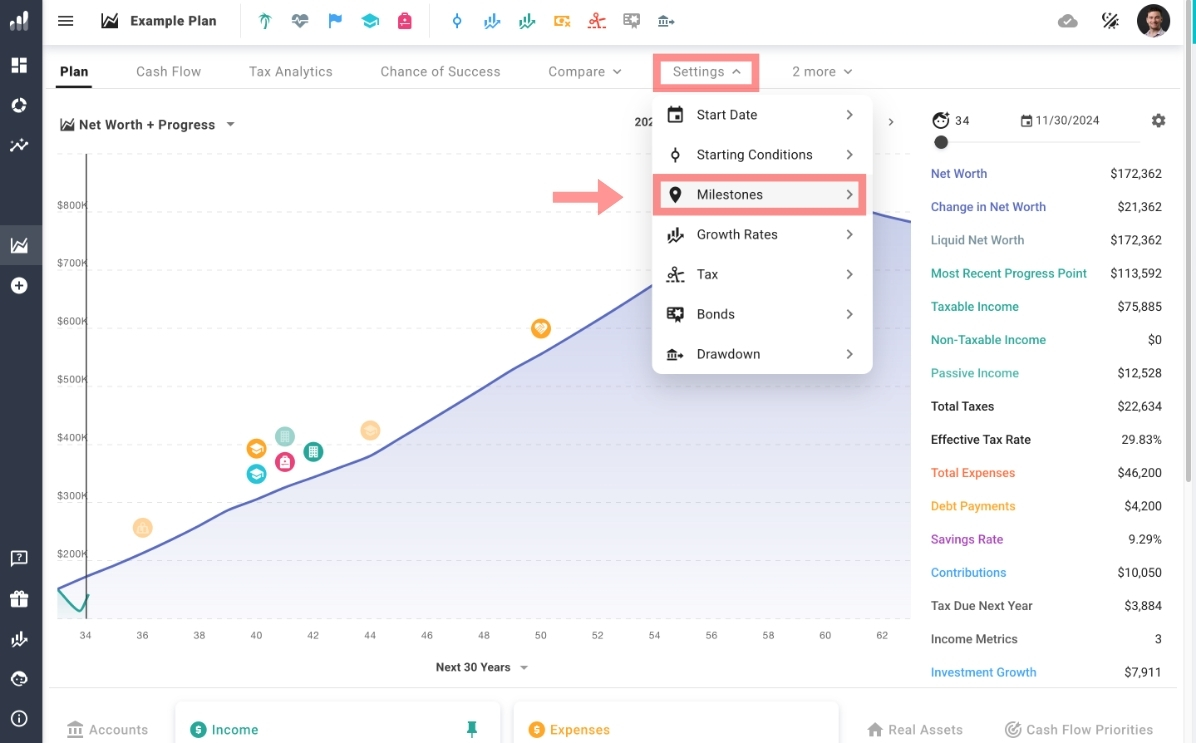

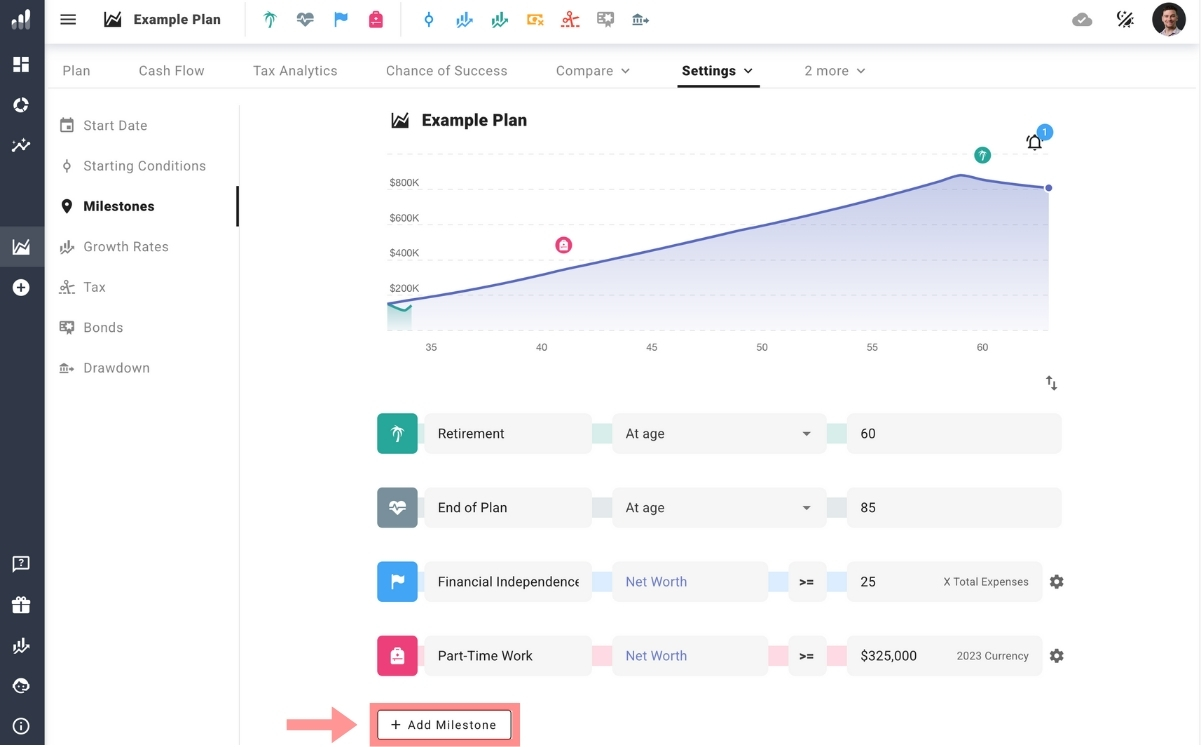

Go to Settings → Milestones → Add Milestone and select the Move milestone option.

Alternatively, select a Custom Milestone for added conceptual flexibility, allowing you to address a wider range of scenarios.

Rename the milestone to reflect your move (e.g., “Move to Florida”) and set the conditions for when it will trigger.

For example:

- Reaching a certain age.

- Achieving a specific net worth.

- Any other criteria you define.

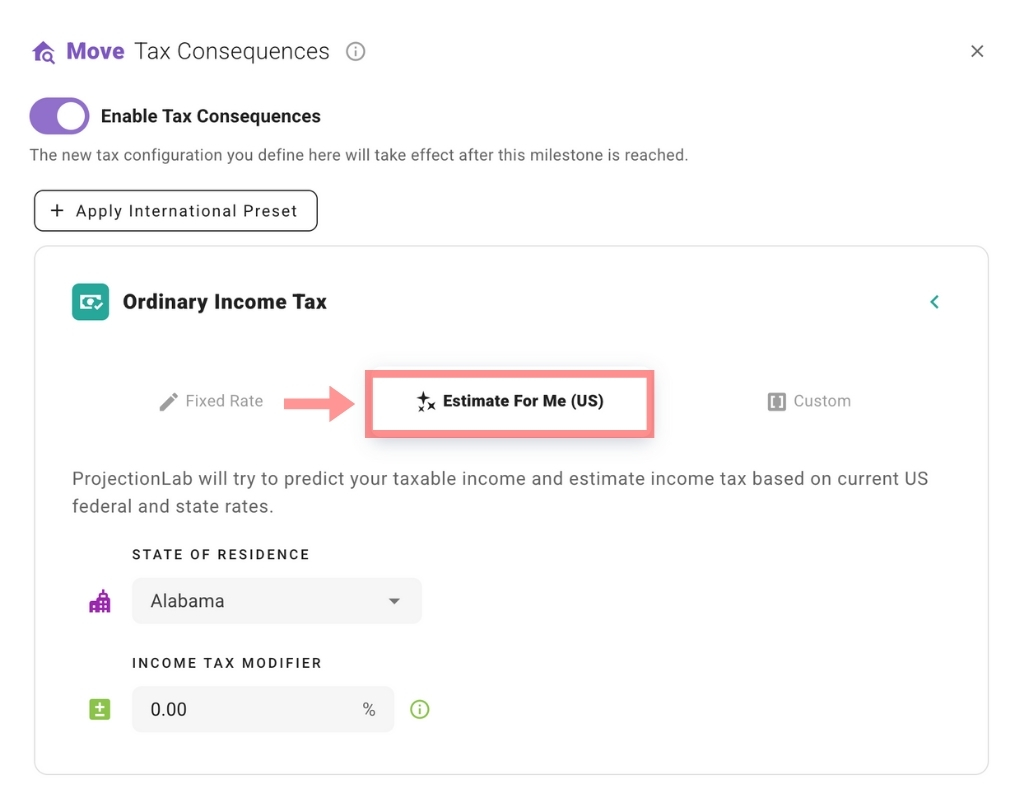

Step 2: Adjust Tax Consequences

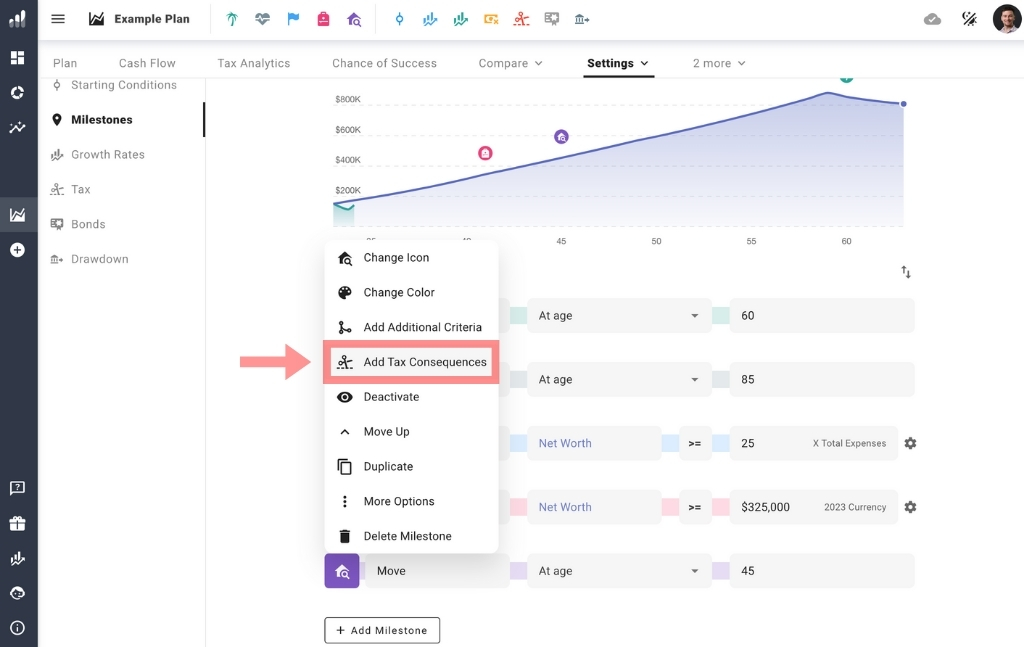

Once your milestone is created:

- Click on the milestone icon, and select “Add Tax Consequences”.

- Enable the tax consequences feature:

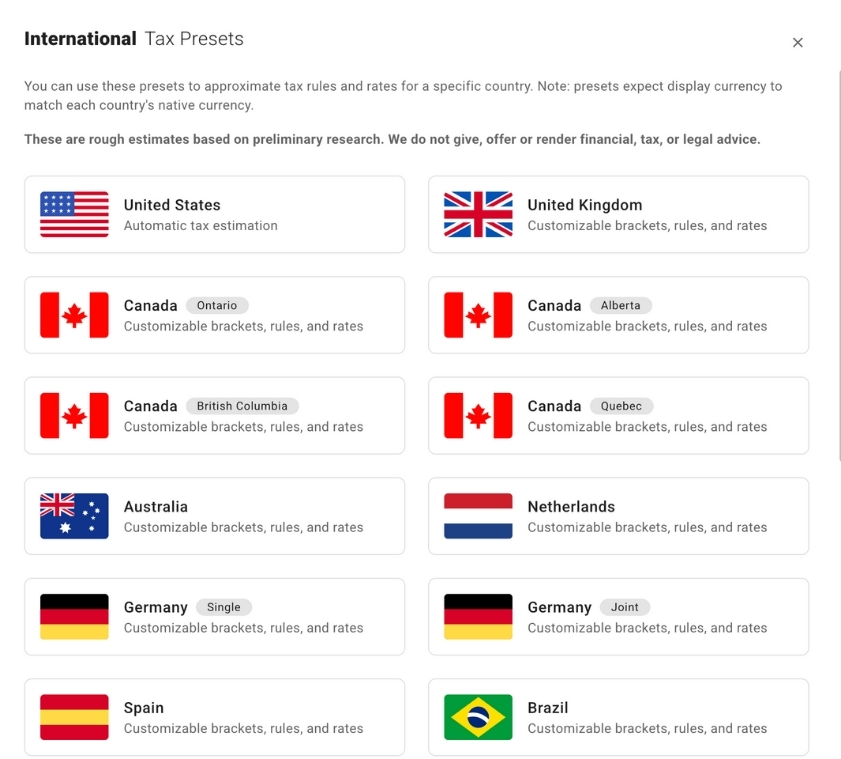

For international moves, choose the preset corresponding to your destination country.

For moves between US states, follow these additional steps after choosing the US tax preset:

- Go to the Ordinary Income Tax section and select “Estimate for Me”.

- Choose the appropriate state of residence to reflect the new tax structure.