ProjectionLab Quick Start Guide

We’re excited to help you start your financial planning journey with ProjectionLab! Whether you’re planning for retirement, setting life goals, or managing your day-to-day finances, ProjectionLab offers powerful tools to help you build a personalized financial roadmap.

Here’s a quick guide to help you get started.

Step 1: Create Your Account

Start by signing up for your free ProjectionLab account via your company invite link. Once registered, you’ll have full access to all of our financial planning tools.

We also recommend watching the Getting Started with ProjectionLab video:

Step 2: Follow the Walkthrough

After logging in, ProjectionLab will guide you through the setup process. This built-in walkthrough will help you navigate entering the financial data needed to create your first plan. Follow along, and you’ll be ready in no time!

Step 3: Complete the Tour

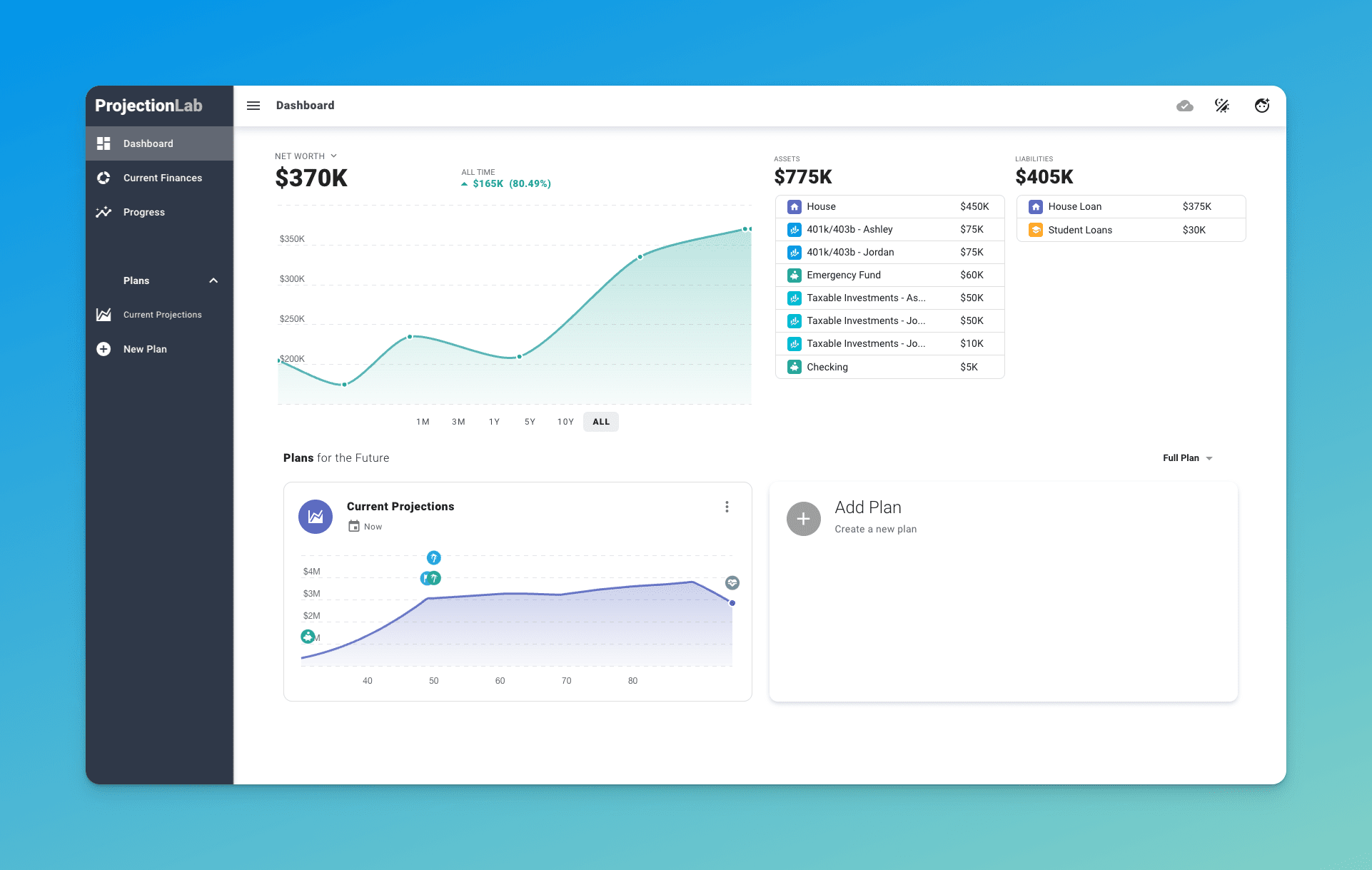

Once the walkthrough is complete, you’ll get a detail tour of ProjectionLab. This tutorial will walk you through your dashboard and show you how to get started building your first plan. It’s a great way to get comfortable using the tool before diving into personal planning.

Step 4: Build Your Financial Plan

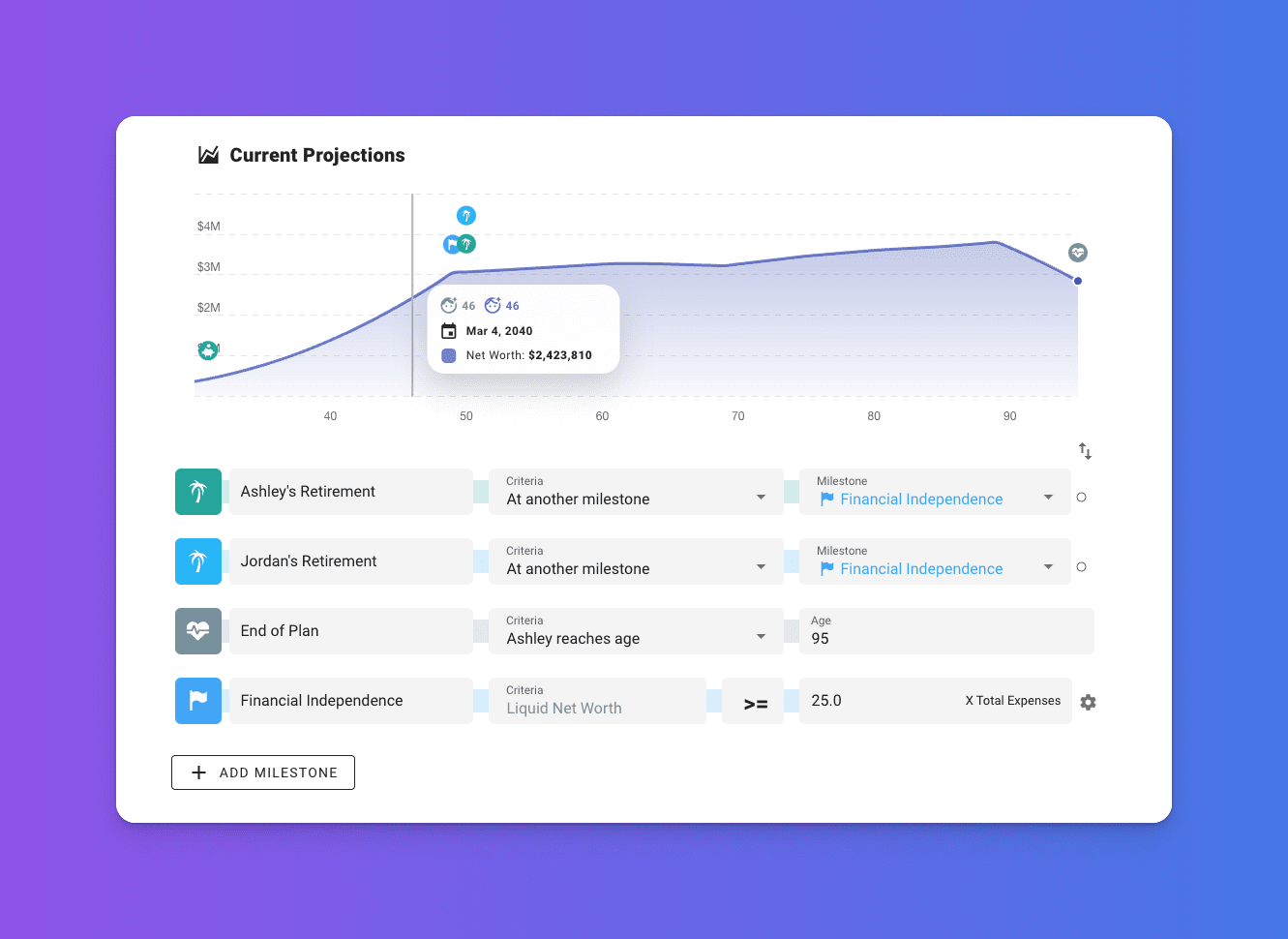

Now that you’ve completed the tutorial, it’s time to build your own financial plan. Start by setting up Milestones—key life events like buying a house, paying off student loans, or planning for retirement. These milestones will help shape your plan and determine when certain financial events occur.

Step 5: Explore Key Features

ProjectionLab offers a range of powerful features to support your financial planning:

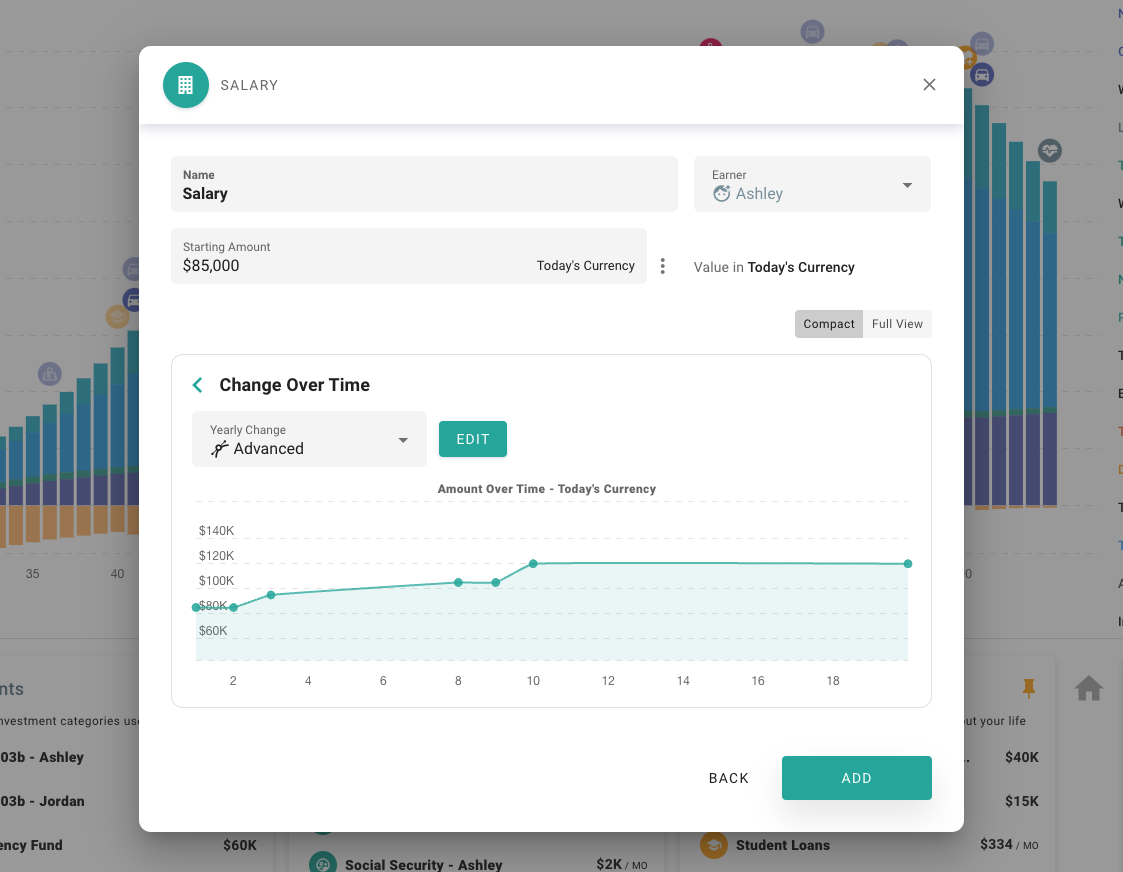

Income and Expense Modeling: Track income growth and changes in expenses over time.

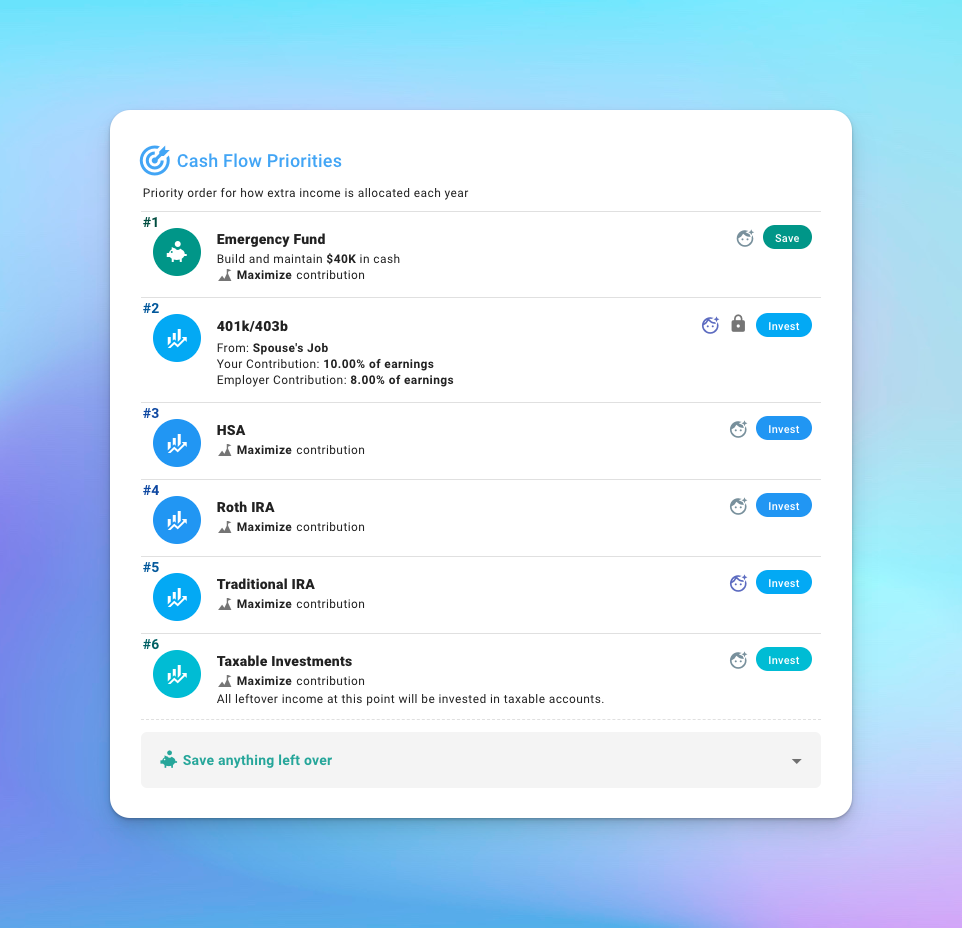

Cash Flow Priorities: Set priorities like building an emergency fund, contributing to investments, or paying off debt.

Real Assets: Track the value of major assets like homes and cars, and customize expense assumptions for each.

Tax Estimation: Use ProjectionLab’s automatic tax estimator or create your own tax configuration based on your location and preferences.

Step 6: Test Scenarios

One of the most powerful features of ProjectionLab is the ability to experiment with different financial scenarios. Use the tools below to test changes and see how they impact your plan:

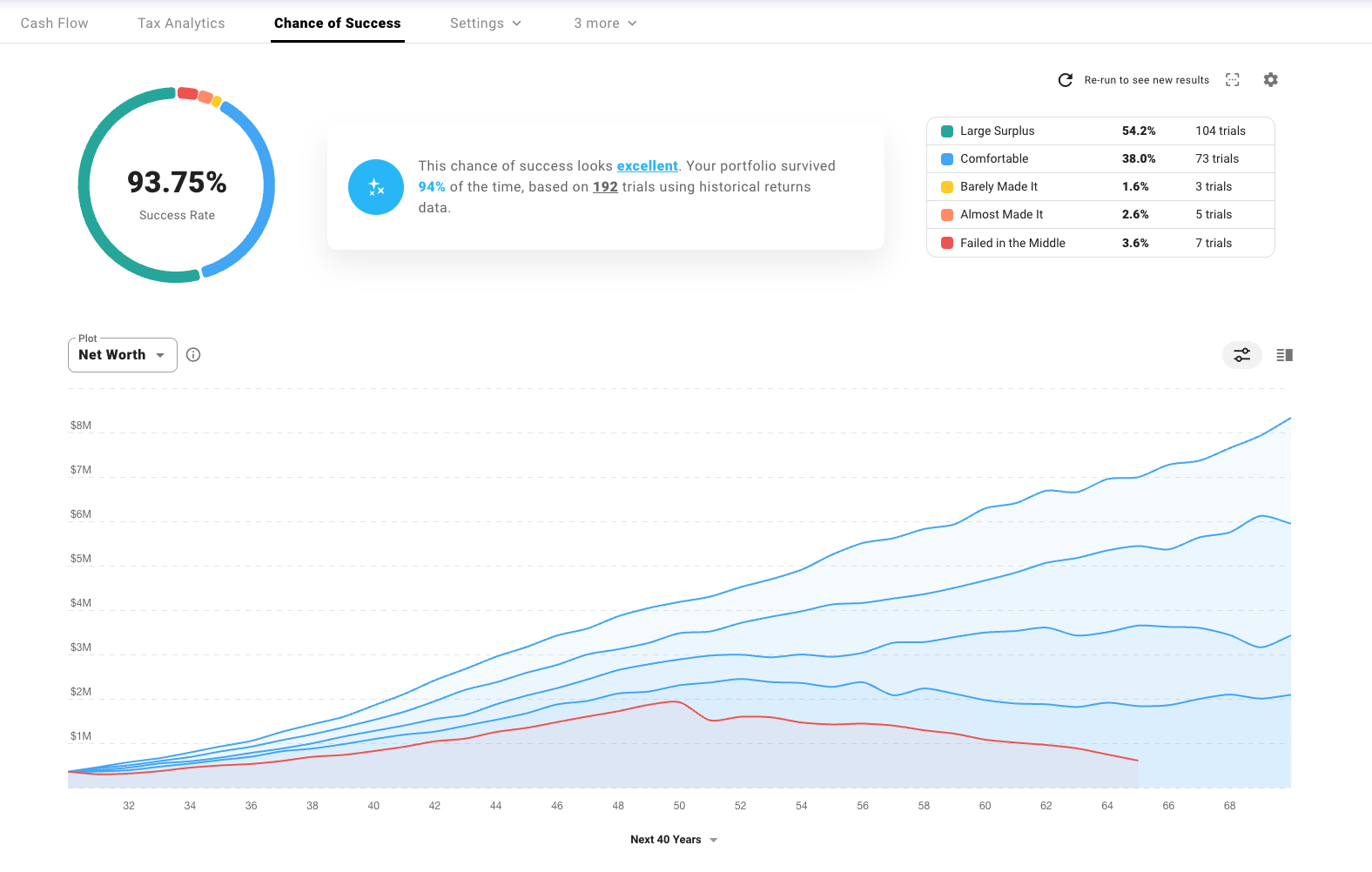

Monte Carlo Simulations: Gauge the resilience of your plan by testing it against historical market data and volatility.

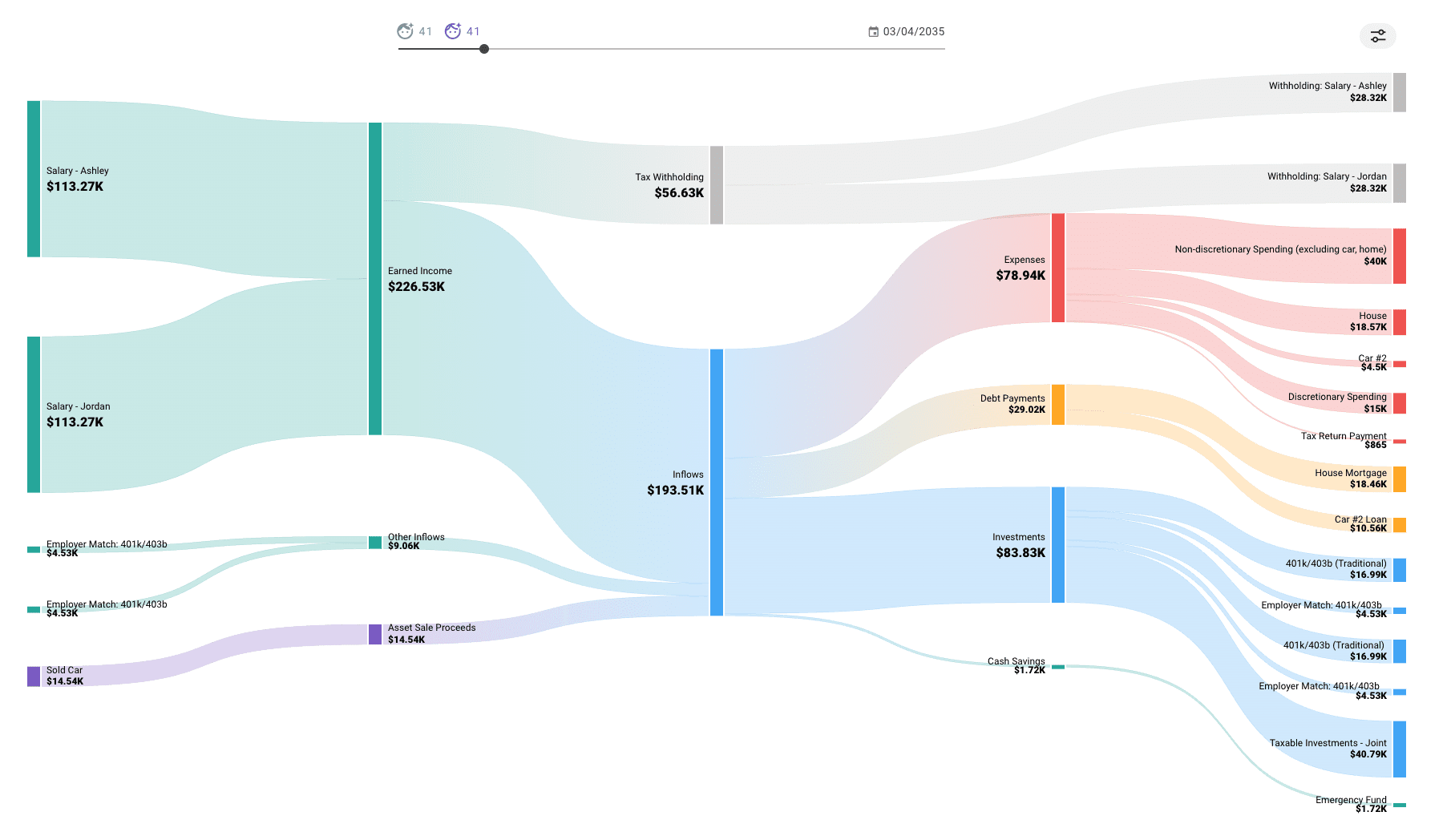

Sankey Cash Flow Chart: Visualize the flow of money in and out of your accounts across the years.

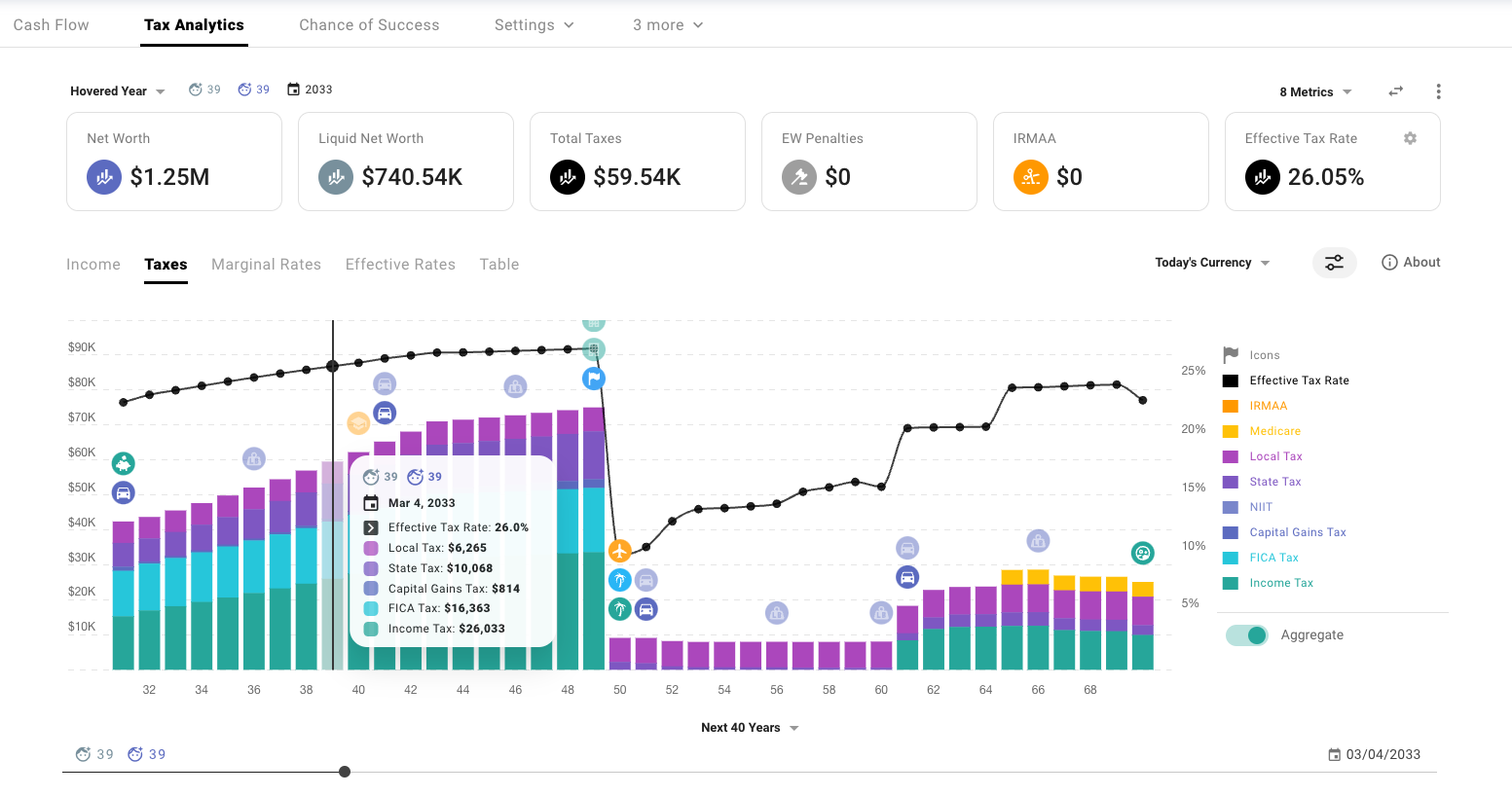

Tax Analytics: Understand how your tax situation changes over time with detailed breakdowns and visualizations.

Step 7: Join the Community

ProjectionLab isn’t just a tool—it’s a community. Join the conversation on our Discord channel to share your experiences, ask questions, and learn from other financial independence enthusiasts. Kyle and the team are active on Discord, ready to help!

You’re Ready to Start!

With ProjectionLab, you’re equipped with the best financial planning software to take control of your financial future. Whether you’re just starting your journey to financial independence or refining your long-term plans, we’re here to support you every step of the way. Dive in, explore the tools, and start building the future you want.