What's New in v4.5.0

Transfers, estate planning, charitable giving, and more.

You can now model account transfers, integrate charitable giving, and see projected legacy and estate taxes, all directly inside your plan.

This release also adds new charts and updated visualizations to make the flow of your money easier to see.

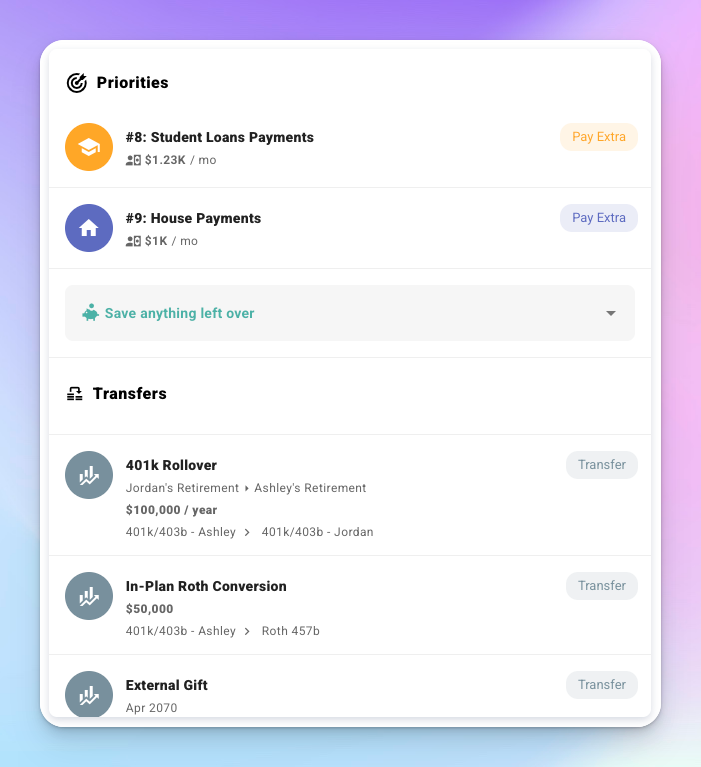

Transfer Funds Between Accounts

Model how money moves between accounts directly. Transfers are a cash flow priority type that handles the tax treatment for common scenarios automatically, with advanced settings when you need more control.

For money that leaves your plan entirely, gifts to family and contributions to outside entities are supported too.

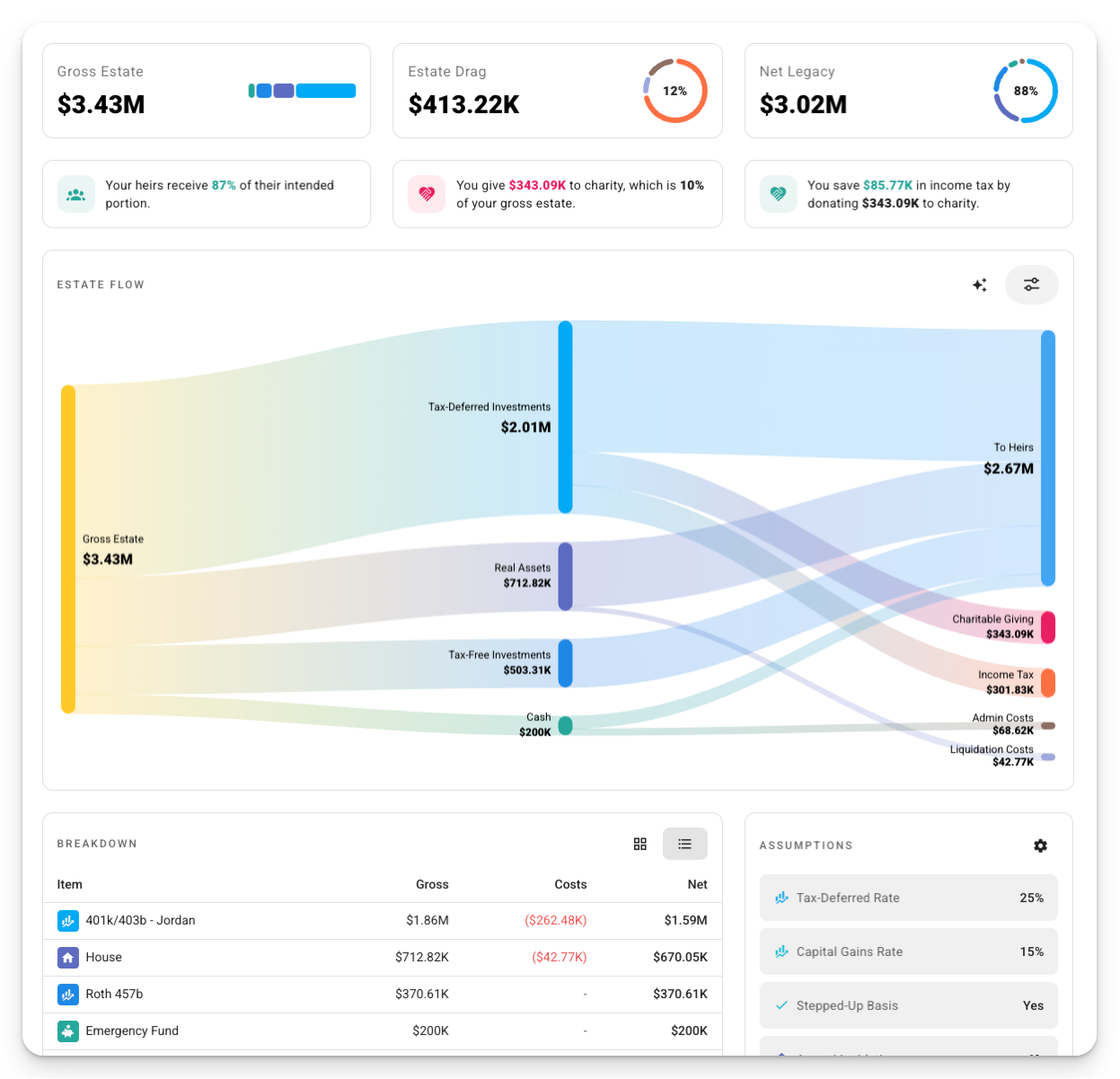

See What Your Plan Leaves Behind

The new Estate tab shows your Net Legacy, which reflects what heirs receive after taxes, costs, and debt rather than just a final net worth number.

It breaks down your gross estate and gives you a quick read on how efficiently your wealth transfers. If your estate is heavy in tax-deferred accounts, for example, you’ll see how that affects what heirs ultimately receive. Federal estate tax (US) and UK inheritance tax are both modeled. Estate metrics also appear in Tax Analytics and Roth conversion analysis, so you can see how decisions you make today affect what you leave behind.

Charitable Giving

If giving is part of your financial planning, it can now be modeled directly rather than treated as an expense.

Qualified Charitable Distributions (QCDs) let you satisfy your RMD while directing the distribution straight to charity, keeping it out of your taxable income. Donor-Advised Funds (DAFs) let you contribute appreciated assets and avoid the capital gains while still getting the full deduction. Deduction carryforward is handled automatically for multi-year giving strategies.

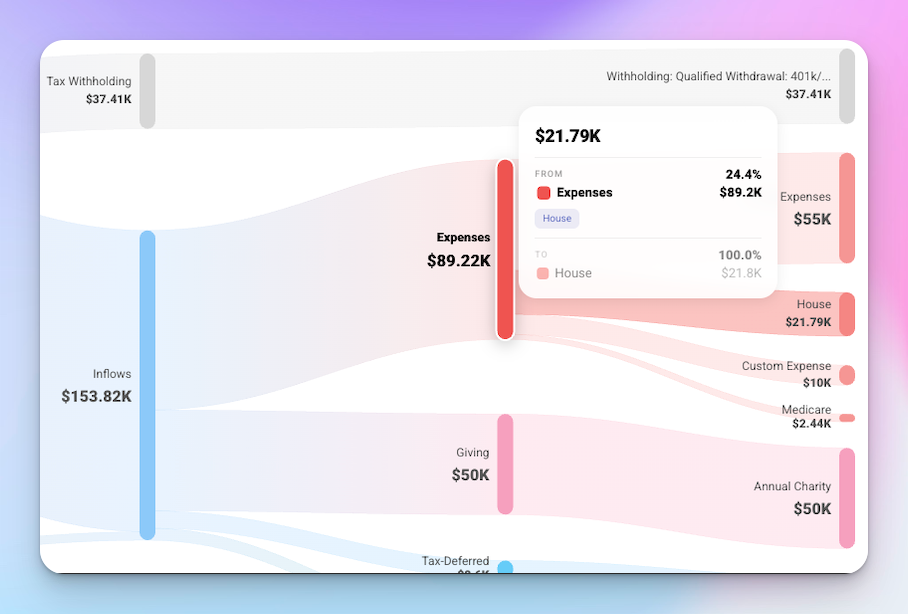

Charts and Visualizations

The Sankey Cash Flow chart has been redesigned with improved grouping, coloring, and animations for a clearer view of where your money flows each year. The Chance of Success milestone section has been revamped with interactive percentile distributions and filtering by milestone timing or outcome.

Explore What’s New

There are many smaller improvements in this release too, including improved event timing, 2025 historical data, and refined tax support for Spain and Germany.

Check out the full release notes or login to explore what’s new in your plan.