How to Optimize Your Canadian Retirement Savings with RRSP Meltdown?

In this article, we’ll explore the concept of RRSP meltdown, a strategy unique to Canadian retirement planning that extends beyond the typical use of Cash Flow Priorities in ProjectionLab.

Possible Benefits to RRSP Meltdown:

You could consider an RRSP meltdown when you want to try to optimize your tax situation by withdrawing funds from your RRSP before the mandatory age. This approach could be beneficial for reducing taxable income at mandatory withdrawal age, if you anticipate being in a higher tax bracket during retirement, when aiming to minimize potential Old Age Security (OAS) clawbacks, or if you want to reduce the tax burden on your estate.

Implementation Strategies:

There are two main approaches to implementing an RRSP meltdown in ProjectionLab:

- Account Transfer Method

- Expense Allocation Method

We also examine the strategy of dividing RRSP withdrawals between spouses to optimize tax efficiency, particularly in relation to the Expense Allocation Method.

Account Transfer Method

This method is ideal when the amount you want to withdraw from your RRSP exceeds your current expenses or when you prefer a more direct approach to route and direct transfers.

Step-by-Step Breakdown

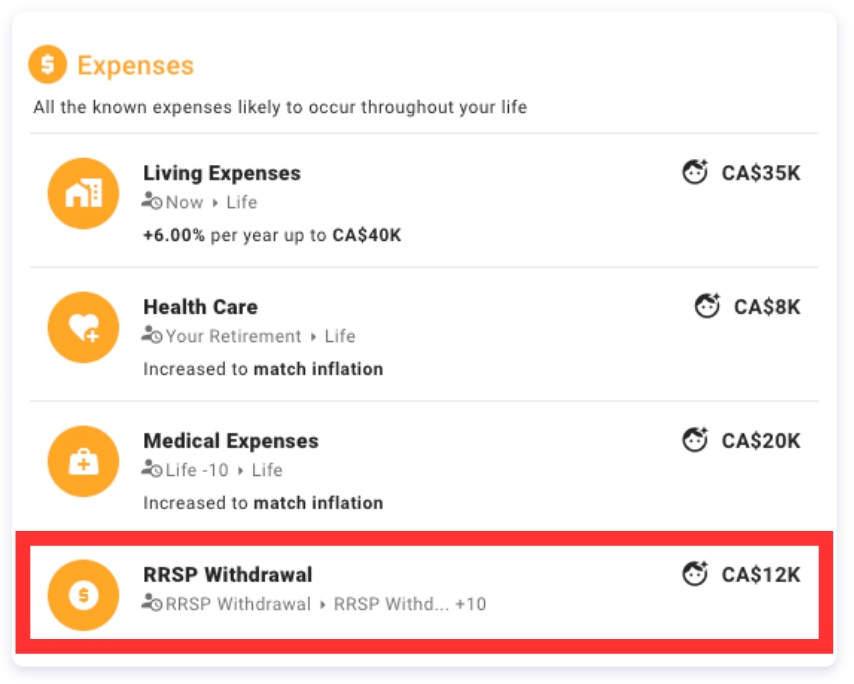

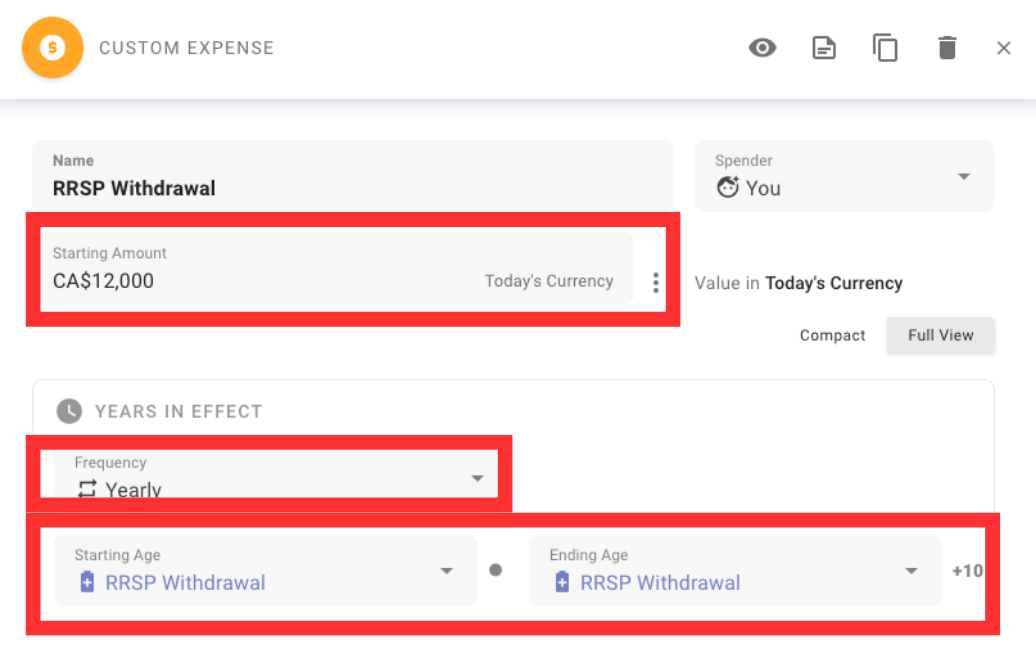

Set Up a Custom Expense Event

- Create a Custom Expense event (e.g., “RRSP Withdrawal”)

- Specify the amount and timing of the withdrawal

Note: In this example, we have utilized the Milestones feature to dynamically connect the expense and income aspects of this single transfer process together, facilitating easier experimentation.

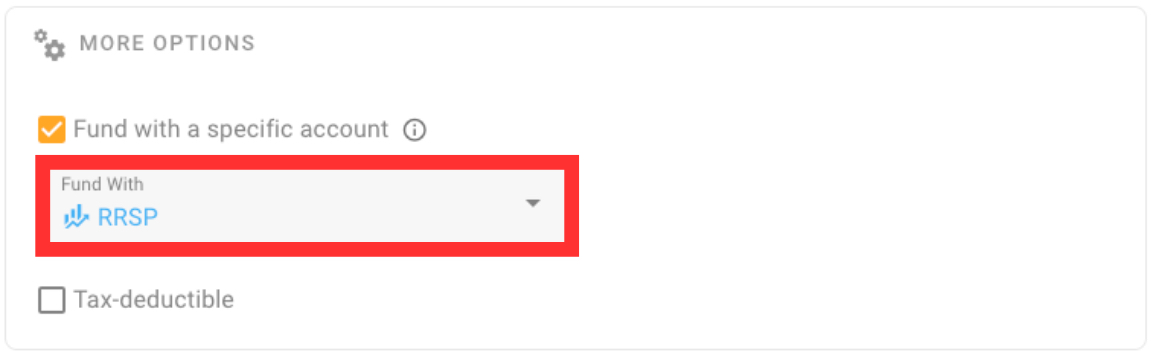

- In Other Settings, select your RRSP as the source account

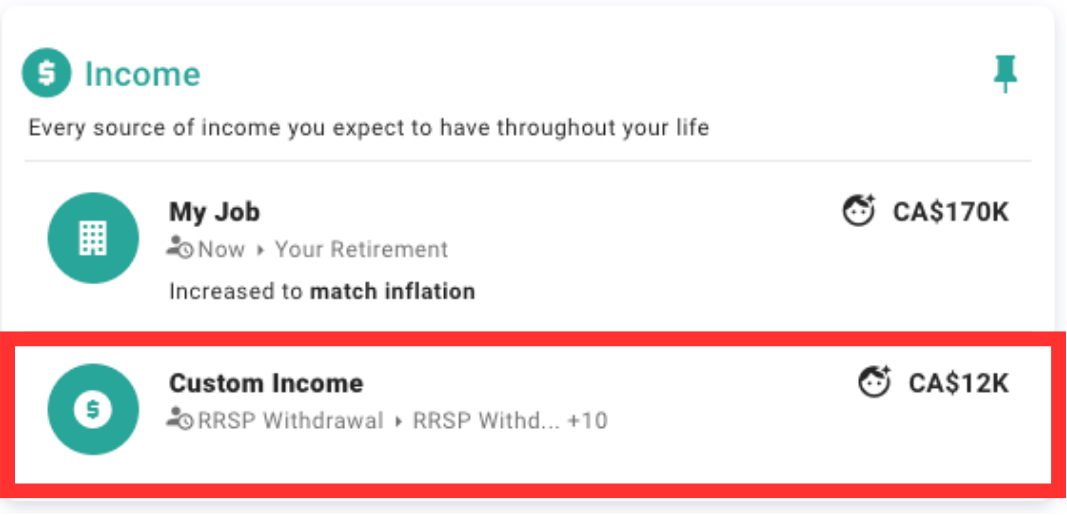

Create a Custom Income Event

- Set up a Custom Income event (e.g., “Taxable Investment Deposit”)

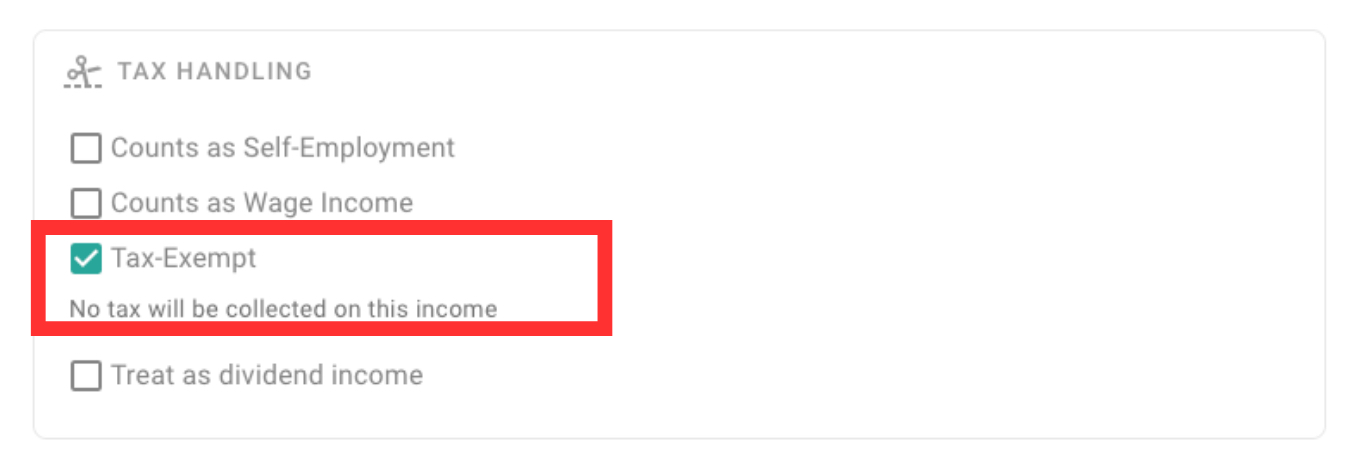

- Classify the event as Tax-exempt under Tax Handling

- Match the amount and timing with the Custom RRSP Expense event (or use a dynamic RRSP Milestone, as mentioned above)

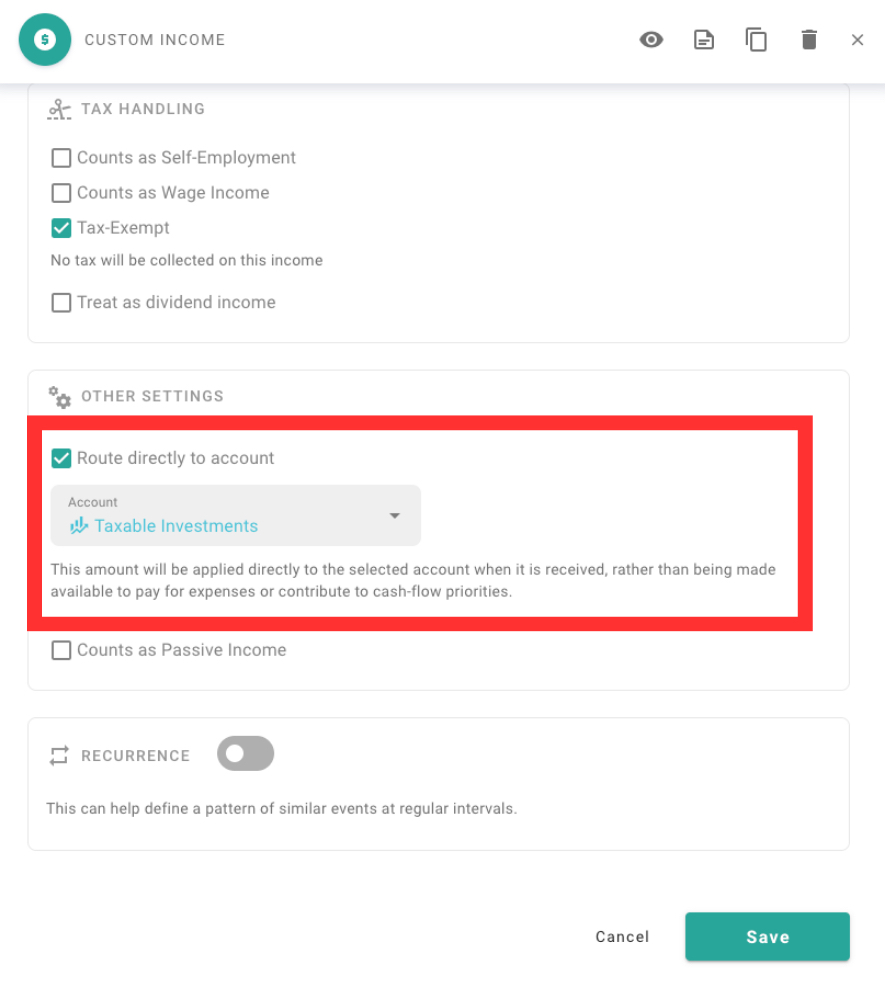

- In Other Settings, select your Taxable Investment account as the destination

Verify the Flow

- Check your Cash Flow to ensure the transfer is working as you intended it.

Please note that an Account Transfer involves multiple steps: funds are first withdrawn from the source account (outflow), then temporarily registered as an inflow, and finally recorded as an outflow to the destination account. This step-by-step process ensures accurate tracking of funds across different accounts. For a more detailed explanation of Account Transfers, please refer to our Account Transfer guide

Expense Allocation Method

Identify Eligible Expenses

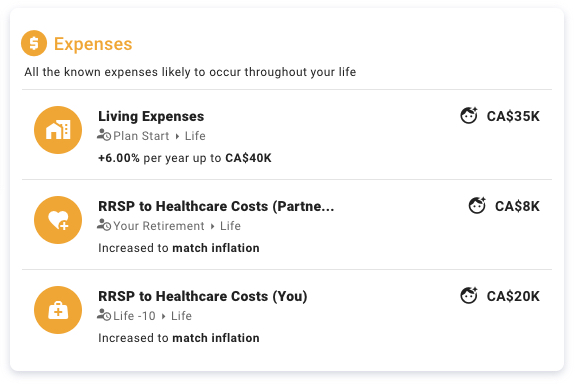

- Review your existing expenses in ProjectionLab

- Determine which expenses RRSP withdrawals should fund

Adjust Expense Settings

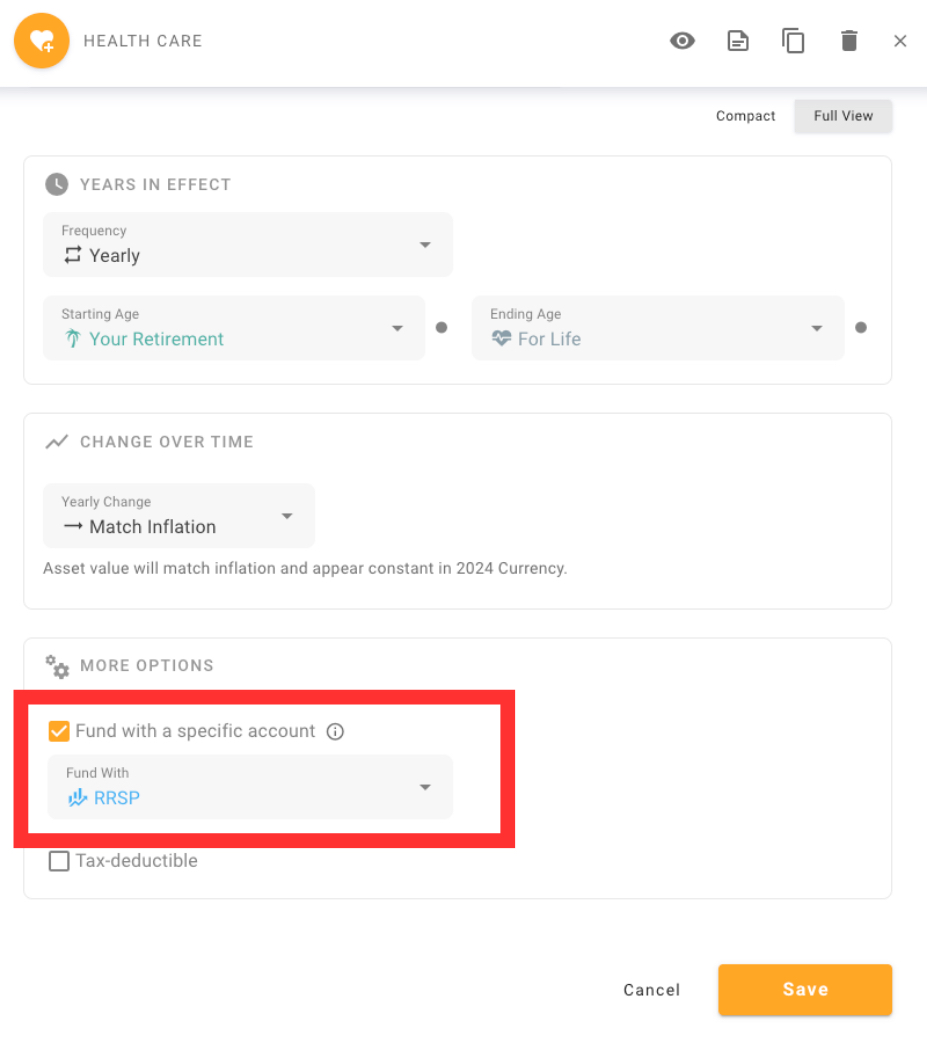

- For each designated RRSP expense, scroll to ‘More Options’ and select the intended RRSP account as the funding source.

Split Withdrawals

- By managing the withdrawal and allocation of RRSP funds between partners, couples can balance their retirement incomes and reduce their overall tax burdens. This approach allows for more flexible income distribution, helping couples maximize their after-tax retirement income and potentially achieve significant tax savings over time.

Monitor Tax Impact

- Use ProjectionLab’s Tax Analytics to assess the effect of your withdrawal strategy on your overall tax situation