Financial Planning Scenarios That Go Beyond Traditional Retirement Calculators

Life is full of questions and decisions—and the answers don’t always come easy. Should you buy a home or keep renting? Start a family, change careers, or plan for early retirement? These aren’t decisions you can make lightly. Each one is connected and shapes your financial future.

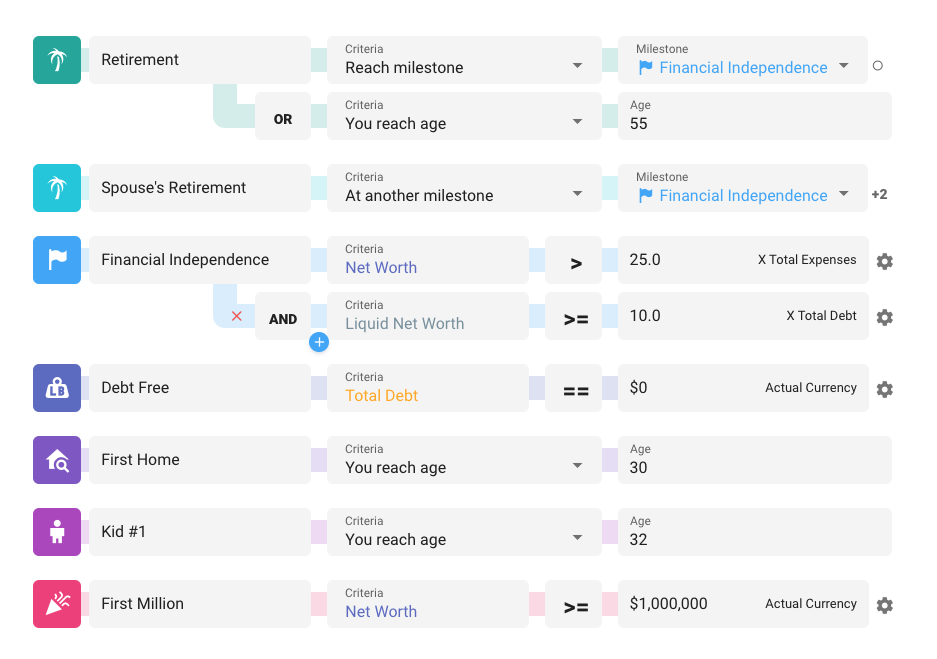

Most financial planning tools focus on one thing: retirement. They give you a savings target or estimate when you might retire. But real life? It’s more complicated than that. Life is a series of milestones and decisions, each with their own set of trade-offs and possibilities. And that’s exactly why we created ProjectionLab.

Unlike a basic retirement calculator, ProjectionLab is built to help you answer the tough “what-if” questions that life throws your way. Whether you’re planning a career shift, starting a family, or just figuring out what’s next, ProjectionLab lets you model different scenarios and see how they fit into the bigger picture.

Why ProjectionLab?

Here’s what makes ProjectionLab different:

- Adaptable to Every Stage: Life changes, and so do your priorities. ProjectionLab lets you adjust your plan to fit where you are today and where you want to go tomorrow.

- Flexibility for Real-Life Decisions: Beyond retirement, you can model housing, career, family, and major expenses, weighing each choice with confidence.

- A Complete Financial Picture: Each scenario affects more than just savings—it impacts your net worth, cash flow, taxes, and financial goals over time.

Let’s dig into a few ways ProjectionLab can help you plan for the things that matter most to you.

Planning for Life’s Big Moments

Some of life’s most rewarding milestones also come with financial responsibilities. Whether you’re starting a family, helping loved ones, or celebrating major events, ProjectionLab helps you stay ahead of the game.

- Having Kids vs. Not Having Kids: Compare the costs of raising children with other life goals, like early retirement or travel.

- Childcare and Education Costs: Plan for daycare, private school, or college tuition, and see how these expenses fit into your overall financial picture.

- Supporting Aging Parents: Explore how providing financial assistance or caregiving affects your long-term goals.

- Saving for Major Events: Budget for life’s big moments—like weddings or milestone birthdays—without sacrificing your financial health.

Navigating Career Transitions

Your career decisions shape your financial trajectory, whether it’s a job loss, taking a sabbatical, early retirement, or a complete career change. ProjectionLab helps you model these transitions to stay on track.

- Going Part-Time or Taking a Sabbatical: Test how reducing your work hours impacts your savings and financial goals.

- Changing Careers or Job Loss: Understand how switching to a new field or getting laid off could affect your finances over time.

- Planning for Early Retirement (FIRE): Map out your path to financial independence and decide how soon you can leave the 9-to-5 grind.

- Calculating Your FIRE Number: Use our free FIRE calculator to determine your financial independence target and see how different scenarios affect your path to early retirement.

- Transitioning From a Side Hustle to Full-Time Business: Evaluate whether your passion project can sustain your lifestyle.

Making Smart Housing Decisions

Housing is one of the biggest financial decisions you’ll make. Whether you’re buying, renting, or investing, ProjectionLab helps you weigh your options and make informed choices.

- Rent vs. Buy: Is it better to keep renting or take the plunge into homeownership? Compare the financial pros and cons.

- Relocating: Moving to a new city? Explore how the cost of living could affect your finances.

- Becoming a Landlord: Thinking about renting out your property? Model potential rental income and the costs of being a landlord.

- Renovations or Upgrades: Plan for home improvements and their impact on your overall financial plan.

Optimizing for Retirement and Taxes

Retirement planning isn’t just about saving—it’s about making your money work smarter. ProjectionLab helps you optimize your retirement strategy to meet your goals.

- Roth Conversions: Explore how converting retirement funds impacts your tax strategy and future income.

- Withdrawal Strategies: Test different ways to draw down your savings for maximum income.

- Tax Projections and Monte Carlo Simulations: Get a clear picture of your tax obligations and test your chance of success.

- Budget for Your Retirement Lifestyle: Plan for the fun stuff—traveling, pursuing new hobbies, or spending more time on your favorite activities.

Health, Lifestyle, and the Unexpected

Your health and lifestyle choices can have long-term financial impacts. ProjectionLab helps you plan for the life you want—even if life throws a curveball.

- Healthcare Costs: Plan for medical expenses, from routine care to long-term care in retirement.

- Taking Time Off for Health Reasons: Whether it’s a medical leave or a focus on self-care, see how it fits into your financial plan.

- Enjoying Life More Now: Want to spend more on hobbies or travel? See how it impacts your future goals.

- Longevity Planning: Ensure your money lasts as long as you do.

Tackling Debt and Big Purchases

Managing debt or saving for big-ticket items? We’ve got you covered.

- Paying Off Debt Early: Whether it’s student loans, credit cards, or your mortgage, see how early repayment could save you money and free up your future cash flow.

- Planning for Major Purchases: From buying an RV to that once-in-a-lifetime vacation, budget for big expenses without derailing your financial progress.

- Vehicle Replacement: Need a new car every few years? Plan ahead to stay on track and avoid financial surprises.

Plan for the Life You Want, With Confidence

Life doesn’t always go according to plan, but that doesn’t mean you can’t be prepared. With ProjectionLab, you get more than just a retirement calculator—you get a financial roadmap tailored to your life.

Whether you’re starting a family, making a career shift, or planning for early retirement, ProjectionLab gives you the tools to confidently take the next step.

Now it’s your turn. Start exploring your financial future today.